Health Spring: Resilience in Exchange for Elasticity

Published Time:

2025-04-16

It's time to test resilience!

On one hand, there is downward pressure from the complex market, policy environment, and the transformation of the pharmaceutical industry; on the other hand, there is an upward opportunity for AI technology to deeply empower pharmaceutical companies to accelerate innovation.

After a period of collective downturn, Chinese pharmaceutical companies have entered a stage of "structural" differentiation.

At this stage, for some listed pharmaceutical companies with stable financial performance, clear strategies, successful "imitation and innovation" transition, and abundant innovative drug pipelines, the marginal diminishing effect of policies such as volume-based procurement will be more obvious.

During the annual report season, how can we identify such pharmaceutical companies? Focusing less on data and more on strategy, understanding whether the company's strategy extending beyond the annual report has the resilience to withstand cyclical fluctuations.

Meeting multiple needs simultaneously. As publicly listed companies, releasing annual reports is becoming increasingly difficult, especially in a poor market environment, where issues are more easily scrutinized and magnified by investors.

For example, even though Jiankangyuan recorded 15.619 billion yuan in total revenue and 1.387 billion yuan in net profit attributable to the parent company for the whole year of 2024, it would be considered by market investors as having "substandard" growth rate, although the slight double-digit decline in revenue and net profit is still considered above average in the overall downturn of the pharmaceutical industry.

Source: Jiankangyuan 2024 Annual Report

Of course, the group psychology of secondary market investors is understandable. After all, in most cases, the stock market reflects irrational speculative behavior, and those who truly observe the investment value of a listed company over the long term are always in the minority.

But the market always favors the "minority".

1| Confidence as the Root

A Confident Financial Statement

The factors that cause changes in the performance indicators of listed companies in the pharmaceutical industry are largely similar, so we should focus on whether the financial statements of listed companies show sufficient stability under the same pressure, so as to first eliminate risk factors and avoid stepping on mines.

At a stage where the core growth data of pharmaceutical companies are still generally adjusting, we need to observe who is more resistant to falls and who can better demonstrate the resilience of cost control and profitability.

For example, although Jiankangyuan's revenue and net profit both showed a consolidation state after a high-growth base, the adjustment was relatively small, and the net profit adjustment was significantly lower than the revenue adjustment, indicating that the company is still improving its profitability.

During the reporting period, Jiankangyuan's profitability indicators, such as a gross profit margin of nearly 63% and a return on net assets of nearly 10%, are also among the top in the industry.

Furthermore, at the end of the reporting period in 2024, Jiankangyuan's total assets were 35.718 billion yuan, down 1.76% year-on-year, but its net assets at the end of the period were 14.535 billion yuan, up 5.66% year-on-year, showing that the company's asset quality is still continuously improving.

In addition to these "inward-looking" indicators that represent the company's own operational management capabilities, we have also observed some "outward-looking" data that convey confidence to the capital market.

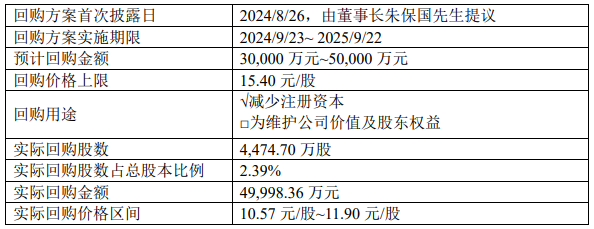

In early March 2025, Jiankangyuan announced that its fifth 500 million yuan repurchase plan, launched in 2024, had repurchased a total of 44.747 million shares, accounting for 2.39% of the company's total shares, and had completed the repurchase and cancellation.

Source: Listed Company Announcement

Previously, Since the repurchase plan started in 2020, a total of nearly 2.7 billion yuan has been invested in five phases to repurchase and cancel company shares, and the cumulative repurchase and cancellation of shares accounts for more than 10% of the total shares.

Jiankangyuan also uses the method of repurchasing and canceling shares to protect shareholder rights and company value. Investment dividends are also a way for the company to return profits to secondary market investors and maintain value.

Following the distribution of 337 million yuan in cash to investors in 2022 and 2023, the company distributed another 366 million yuan in cash dividends to investors in 2024.

Including the investment in share repurchases and cancellations, Jiankangyuan's cumulative cash dividends in the past three years reached 2.568 billion yuan, and the ratio of cumulative cash dividends (repurchases + cash dividends) to average annual net profit attributable to the parent company (1.444 billion yuan) is as high as 177.84%.

Among the pharmaceutical companies tracked by "Polypeptide Chain", listed companies are increasingly focusing on returning to investors by increasing dividend distributions, which shows that listed companies are full of confidence in their future development.

Companies like Jiankangyuan, which use "dual approaches" of large-scale, high-proportion repurchases and cancellations and long-term stable dividend distributions, are quite rare in the A-share market.

This also sets a good example for listed companies in the pharmaceutical industry to protect the value of investors and the company.

2| Innovation as the Soul

The Strength of Strategic Determination

In the future structural differentiation of pharmaceutical listed companies, innovation capability is the biggest watershed.

The three words "innovative drugs" are the best "protective amulet" for pharmaceutical companies to cope with environmental pressures such as volume-based procurement. It is now a collective consensus in the pharmaceutical industry, but cause and effect are not achieved through last-minute efforts. Pharmaceutical companies need sufficient strategic foresight.

This strategic foresight in Jiankangyuan can be traced back to 2013.

In that year, Jiankangyuan made a decision that changed its destiny—in view of the major trend that Chinese society would accelerate into an aging society, it decisively bet on the respiratory disease drug market.

With this as an "anchor", Jiankangyuan attempted to use "innovative drugs" to leverage the future market.

Whether it is raw materials, chemical drugs, or others, they will still be the company's basic market for a long time, but innovative drugs are the real "main beam" that supports Jiankangyuan's growth space.

In 2019, under the guidance of the firm adherence to the "innovation-driven" strategy, Jiankangyuan ushered in the most important breakthrough in the field of respiratory disease drugs, overcoming the technical barriers of high-end inhalation preparations.

Levosalbutamol hydrochloride nebulization solution became Jiankangyuan's first inhaled drug to be listed, not only filling the market gap of "domestic substitution", but also laying a solid foundation for the company to establish its leading position in the domestic respiratory drug field.

Four years after the launch of its first product, Jiankangyuan's respiratory drug sales have increased by 22 times, realizing the strategic value of innovation. More importantly, under high-intensity R&D investment and differentiated innovation, the company has gradually built a rich pipeline of innovative drugs.

From the perspective of innovation-driven strategic depth, focusing on the respiratory field, HealthGen currently has 11 Class 1 innovative drug products in reserve. Among these, in addition to Mapasibave Capsules, which have entered the final stages of market launch, TSLP monoclonal antibody, IL-4R monoclonal antibody, MABA inhalation solution, and GSNOR inhibitor have all entered Phase II clinical trials.

Source: Public information from listed companies

In the respiratory field, HealthGen possesses an innovative drug pipeline covering multiple indications and dosage forms. Its rich product portfolio and first-mover advantages have solidified its position as a leader in respiratory medicine, and it is now entering a period of value and revenue realization.

From the perspective of innovation-driven strategic breadth, in addition to the respiratory field, HealthGen has also diversified its layout in areas such as digestion, assisted reproduction, analgesia, cardiovascular disease, and mental illness, currently reserving more than 20 innovative drugs.

Looking further, the domestically produced innovative PPI drug, Aprazole, has enabled HealthGen to gain a leading position in the digestive tract field. Aprazole is considered a new drug with a global market sales potential of US$1 billion.

In the field of assisted reproduction, HealthGen has also built a complete product matrix, with its core products having long occupied the top ranks of the sub-market; in the field of analgesia, innovative drugs introduced through BD and other methods are also accelerating their progress under the support of HealthGen's innovation platform.

The intertwined strategic depth and breadth of innovation drive HealthGen to be not only an "innovative" pharmaceutical company with a rich pipeline of innovative drugs across multiple therapeutic areas, but also a rare example of a domestic Chinese Big Pharma.

For individual enterprises, the innovation pipeline determines the sustainability and imagination of future growth, but for Chinese innovative drugs, HealthGen's successful transformation is a key leap in forging global competitiveness in the next decade.

III| Value as the Foundation

Resilience Brings Elasticity

For new drug R&D, which is extremely capital-intensive, has extremely high technical barriers, and extremely high time costs, how can a pharmaceutical company's innovative R&D capabilities be objectively evaluated under the pre-condition of risk control? This is definitely an issue that needs to be taken seriously.

Observing the ratio of R&D investment to a pharmaceutical company's revenue and the absolute value of its scale is often an important support for the external "evidence-based" assessment of a pharmaceutical company's innovative R&D capabilities.

However, using a higher revenue ratio and a larger absolute investment value to examine a pharmaceutical company's innovation ability can easily lead us astray in evidence-based assessment.

In many pharmaceutical companies that are gambling on R&D spending, it is not difficult to find the real risks of R&D failure or results far below expectations.

Innovative new drugs are not an "adrenaline shot" for investors, but a decision and choice that weighs the risk factors in the R&D pipeline against the company's sustainable development.

Looking back, in the 23 full fiscal years since HealthGen's listing in 2001, it has been able to achieve a compound annual growth rate of over 15% in revenue, weathering major challenges such as the financial crisis, the epidemic impact, and volume-based procurement reforms, while consistently ensuring the resilience of its profitability. How?

Whether it's health products, raw materials, chemical drugs, or today's innovative drug pipeline, the focus of every step of HealthGen's strategic development has been "closely around clinical needs".

Only innovation that can be fully value-converted is effective innovation.

R&D investment in 2023 was 1.632 billion yuan, and in 2024 it was 1.532 billion yuan. Despite facing layers of pressure in these two years, HealthGen has still been balancing R&D investment and market risks, while firmly investing about 10% of its annual revenue in R&D.

Source: Jiankangyuan 2024 Annual Report

This R&D-to-revenue ratio, compared horizontally with industry-scale pharmaceutical companies, is undoubtedly "first-tier." But importantly, this is the result of "精算" (precise calculation) based on the company's long-term innovation strategy.

Because HealthGen's layout of more than 20 innovative drug pipelines has only one basic principle: "clinical needs." If we add a qualifier, it would be the "unmet" clinical therapeutic needs.

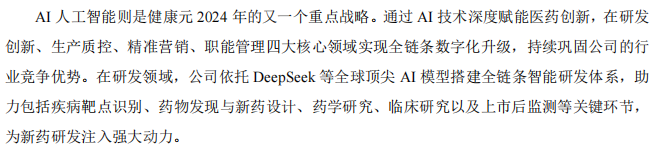

In 2024, the landscape of innovative drugs in China ushered in a "singularity"—AI technology using Deepseek as an innovative application has brought a new "X" factor to China's innovative drug R&D.

For HealthGen, with its full innovative drug pipeline layout, this is simply wonderful.

Because the practical significance of fully implementing Deepseek in drug R&D, clinical medicine, production and quality management, and commercialization far exceeds the value of capital market hype and inflated market capitalization.

Especially in the field of innovative drug research, HealthGen has clear application scenarios: actively exploring and practicing from the two key directions of CADD (Computer-Aided Drug Design) and AIDD (Artificial Intelligence Drug Discovery).

CADD technology can be used to conduct virtual docking screening for relevant signaling pathway targets. This means that R&D costs will be greatly reduced, and efficiency and success rates will be greatly improved;

In terms of AIDD, through in-depth application in multiple key links such as molecular discovery, pharmaceutical research, and clinical research, HealthGen can use this to further expand its innovative drug pipeline layout.

Of course, the application of AI technology in production and sales to improve operational efficiency need not be elaborated. At least, the company's open-minded and proactive embrace of AI is "clearly expressed."

Source: Jiankangyuan 2024 Annual Report

According to the company's statement: HealthGen will continue to promote the deep integration of AI and the pharmaceutical industry, building an intelligent platform covering the entire chain of "R&D—production—commercialization" to provide patients with safer, more effective, and accessible drugs and treatment options.

Therefore, With the support of AI technology, accelerating the realization of the value of the existing innovative drug pipeline into the company's performance growth momentum is foreseeable.

With confidence as its root, innovation as its soul, and value as its foundation, the development resilience shown by HealthGen is also transforming into the elasticity of its future growth.