In 2024, how did Health Yuan answer the "three philosophical questions of life"?

Published Time:

2025-04-11

Socrates' famous questions, "Who am I?", "Where do I come from?", and "Where am I going?", are the three fundamental questions of life.

Similarly, a company, especially a publicly listed one, cannot avoid these questions: "What kind of company is this?"

"Where does the company's money come from?" "Where does the company's money go?"

-

The confidence of a bull market

Recall that in the first 10 days of March, the number of brokerage firm market research reports with the title involving "bull market" surged, including Huachuang Securities, Xinda Securities, CITIC Securities, Guosheng Securities, Zheshang Securities, Tianfeng Securities, and GF Securities, etc.

Based on in-depth analysis of macroeconomic conditions, policy orientation, and capital flows, the bull market judgment made by sell-side research may be an accurate insight into the real market trend. However, some voices suggest it could be a market "contrarian indicator," meaning that when brokerage reports frequently mention a "bull market," it often foreshadows an upcoming market adjustment period.

On April 7, affected by the uncertainty of tariff policies, the three major A-share indexes fell collectively. By the close, the Shanghai Composite Index fell 7.34%, the Shenzhen Component Index fell 9.66%, the ChiNext Index fell 12.5%, and the North Securities 50 Index fell 17.95%.

Regardless of the index, A-shares ushered in the annual report season as scheduled, and it's once again time to show off the muscles.

As of April 7, a total of 1184 listed companies in A-shares have disclosed their 2024 annual reports, of which 1025 were profitable and 159 were loss-making. In terms of net profit, 256 companies had a net profit exceeding 1 billion yuan, accounting for a quarter of the total number of companies that have disclosed their reports.

Health Yuan submitted its report on the evening of April 7. According to the company's 2024 annual report, during the reporting period, Health Yuan achieved operating revenue of 15.619 billion yuan and net profit attributable to shareholders of listed companies of 1.387 billion yuan. A cash dividend of RMB 2 per 10 shares was distributed to all shareholders.

-

How did Health Yuan transform into an innovative pharmaceutical company?

During the key development phase from 2022 to 2024, Health Yuan achieved a significant leap from generic drugs to innovative drugs in several key therapeutic areas, including respiratory, analgesics, digestive, and mental health. The company has successfully built a pipeline of more than 20 innovative drugs covering important indications such as asthma, COPD, antidepressants, and gout.

In 2019, the first product, Shutanlin (inhaled compound ipratropium bromide solution), was launched, breaking through the technical barriers of high-end inhaled preparations. The sales performance of respiratory products grew rapidly, achieving a 22-fold increase in four years, successfully establishing a leading position in the domestic respiratory field.

In the respiratory field, Health Yuan made a breakthrough with Shutanlin, opening up a broader horizon. Thanks to its early layout and continuous efforts in the respiratory field, Health Yuan currently has 10 products on the market, with a rich variety. It has successfully broken the long-term monopoly of multinational pharmaceutical companies, and its market share ranks among the first tier. In addition, the company closely focuses on clinical needs and has reserved more than 10 innovative drug projects of Class 1, accumulating strength for long-term development.

In short, in the respiratory field, Health Yuan is not just leading, but pioneering, with remarkable achievements in respiratory innovation.

More importantly, accumulation! In the respiratory field, Health Yuan has accumulated experience and resources in a full-chain process centered on "R&D-production-sales." Undoubtedly, this accumulation will help the company achieve innovation in other fields.

For example, in the high-barrier complex preparation technology field, the company has achieved multiple national firsts, such as China's first and currently only inhaled antibiotic tobramycin inhalation solution and China's first salmeterol/fluticasone propionate powder inhaler "Jiankechang" approved for marketing.

Therefore, the technology platform formed by the company's years of deep cultivation in innovative drugs and high-barrier complex preparations enables the company to overcome complex technological challenges in drug R&D and production.

The other side of accumulation is keeping up with the times. In the R&D field, the company relies on global top AI models such as DeepSeek to build a full-chain intelligent R&D system, assisting key links including disease target identification, drug discovery and new drug design, pharmaceutical research, clinical research, and post-market monitoring, injecting strong impetus into new drug R&D.

In the future, Health Yuan will use AI technology to deeply empower pharmaceutical innovation, achieving full-chain digital upgrading in four core areas: R&D innovation, production quality control, precise marketing, and functional management.

With significant investment and resolute execution, Health Yuan currently holds more than 10 innovative respiratory drugs, accelerating clinical trials, and multiple projects are leading in domestic progress.

-

Is Health Yuan profitable?

Health Yuan was listed in 2001.

In 2001, Health Yuan's total revenue was 679 million yuan, and its net profit was 201 million yuan. It then went on to achieve rapid growth. By 2017, the company's total revenue entered the "10 billion yuan" club, reaching 10.779 billion yuan, and its net profit also reached a record high of 2.133 billion yuan. Subsequently, it entered a period of stable development.

From 2017 to 2024, Health Yuan's total revenue exceeded 100 billion yuan, and its net profit exceeded 10 billion yuan.

Health Yuan's performance

After being tempered by various stories in the capital market in recent years, investors now attach great importance to "cash flow." There is no other reason; cash flow is more real.

Cash flow reflects a company's ability to generate cash through its core business (drug R&D, production, sales, etc.) and is a key indicator for measuring the quality of earnings and financial health. Stable cash flow means that the main business has a sustainable ability to generate cash, which can cover operating costs, repay debts, and support future development.

The pharmaceutical industry has characteristics such as high R&D investment, long cycles (from R&D to listing may take more than 10 years), strong regulation (such as medical insurance negotiations, volume-based procurement), and policy sensitivity (such as patent cliffs, volume-based procurement price reductions), making stable cash flow particularly crucial.

Health Yuan undoubtedly understands the principle of "cash is king." The company has always maintained an appropriate level of cash flow. While maintaining high R&D investment, it has also responded to the changing external environment and maintained a stable and strong profitability, which is rare among innovative pharmaceutical companies, but Health Yuan has achieved it.

Although Health Yuan cannot yet be called a time-honored enterprise, in the A-share market, a veteran pharmaceutical company with more than 20 years of history that can still maintain such stability can be called "reliable Yuan".

-

Where did Health Yuan's money go?

First, it takes from the (share)holders and uses it for the (share)holders

Since its listing in 2001, the company has undergone three rounds of financing, raising a total of 4.452 billion yuan.

Comparison of Health Yuan's Dividends and Financing (Source: Oriental Fortune)

The dividend-to-financing ratio is one of the key indicators for investors to judge whether a company has the potential for sustainable growth. A higher dividend-to-financing ratio usually indicates that the company has sufficient cash flow to support its future development and is able to provide stable dividend income to shareholders. Therefore, for long-term investors, choosing companies with a high dividend-to-financing ratio can bring higher returns and security.

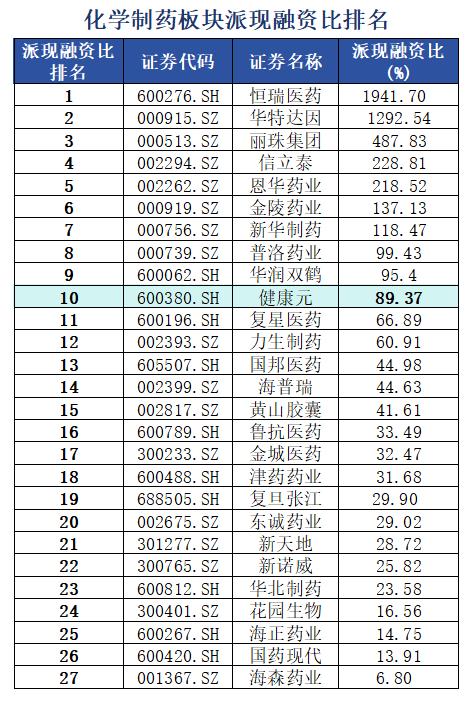

Among chemical pharmaceutical companies that announced their annual reports by March 31, Health Yuan's dividend-to-financing ratio ranked high.

Ranking of Dividend-to-Financing Ratio in the Chemical Pharmaceutical Sector

Health Yuan completed its latest share repurchase on March 6, 2025. The company has repurchased a total of 44.747 million shares through concentrated bidding transactions, accounting for 2.39% of the company's total share capital. The highest purchase price was 11.90 yuan/share, the lowest price was 10.57 yuan/share, and the average repurchase price was 11.17 yuan/share. A total of 500 million yuan (including handling fees) has been paid.

Since 2020, five share repurchase plans have been launched. Health Yuan's accumulated dividends plus repurchase funds are nearly 4 billion yuan. Over the past three years, the company's cash dividends plus repurchase amounts have accounted for an average of over 60% of the latest audited net profit attributable to the parent company.

In addition, it is worth mentioning that Health Yuan's repurchases are all cancellation repurchases. Through repurchase and cancellation, the company's share capital has been reduced, and coupled with a high proportion of cash dividends, earnings per share have been significantly improved. Investors have received more substantial returns. In a horizontal comparison, the company's share capital after repurchase and cancellation has exceeded 10%, and its repurchase and cancellation intensity and proportion are among the top in A-share listed companies.

Secondly, it is necessary to mention R&D investment. For many years, Health Yuan has insisted on allocating about 10% of its profits annually to support R&D. According to media statistics, among the top 20 pharmaceutical companies in China in terms of R&D investment in 2023, Health Yuan ranked 14th with an investment of 1.632 billion yuan.

Against the backdrop of fierce competition in the industry, this achievement not only reflects the company's forward-looking strategic vision, but also demonstrates its innovative responsibility as a representative of national pharmaceutical companies.

According to the latest disclosed 2024 annual report, Health Yuan continues to increase its R&D investment, with a total R&D investment of 1.532 billion yuan for the year. From the laboratory to industrialization, Health Yuan is achieving continuous improvement as an innovative pharmaceutical company through continuous technological breakthroughs.

Health Yuan's R&D Investment

Ranking of R&D Investment in the Pharmaceutical Sector (Source: Pharmaceutical Online)

As a long-term value creator in the pharmaceutical and health field, Health Yuan has overcome industry cycles over the past two decades with a compound annual revenue growth rate of 14.6%, maintaining profitability resilience in the face of major challenges such as the financial crisis, the epidemic impact, and volume-based procurement reforms, rewarding investors and benefiting more patients. In 2024, Health Yuan once again delivered a satisfactory performance.

This article is reproduced from: Serious Finance